HEALTHCAREDIVE- AUTHOR -Les Masterson- Nov. 13, 2018

Dive Brief:

The health insurance industry is the least satisfying category in any sector, according to the latest report from the American Customer Satisfaction Index (ACSI).

ASCI found that the health insurance industry’s scores were flat after two years of gain.

Overall, health insurers averaged a score of 73 out of a possible 100, which is the same as a year ago. Humana and Kaiser Permanente topped the survey with scores of 78. Both companies dropped by one point in 2018.

Dive Insight:

ASCI surveys people on the finance and insurance sector, including banks, credit unions, property and casualty insurance, life insurance, internet investment services, financial advisors and health insurance. For this year’s survey, the group interviewed 25,555 customers between Oct. 2, 2017, and Sept. 26.

Overall, customer satisfaction with the finance and insurance sector increased by 1.4% and reached its highest level in 24 years (78.3).

“Health insurance is complicated and controversial, making it by far the most problematic and least satisfying category in the sector,” David VanAmburg, managing director at the ACSI, said in a statement.

Kaiser Permanente ranked No. 1 for fastest to process claims and the best prescription coverage. Humana was the leader in offering access to primary and specialty care.

An interesting twist is that two companies in the middle of mergers both improved scores from 2017. Aetna increased from 74 to 75 and Cigna jumped from 66 to 73. Aetna ranked No. 1 for its mobile app. Cigna, which had the lowest marks a year ago, offered the lowest complaint rate in the industry, ACSI said.

Overall, health insurance has improved access to primary care doctors (80). Access to specialty care remained at 78. Respondents said medical coverage is slightly better than a year ago. Prescription drug coverage, ease of submitting claims and speed of claims processing all remained the same

On the other hand, respondents voiced concern about health insurance mobile apps and website satisfaction. Call center satisfaction dropped 5% to 71, which was the lowest score in the sector.

Health insurance companies are usually not thought of in the same breath as an Apple, Amazon or Starbucks, which enjoy strong brand loyalty. When consumers deal with their health insurers, it’s often for billing disputes or other difficult experiences. Payers are trying to change that perception through efforts like population health and collaborating with providers and patients to improve outcomes.

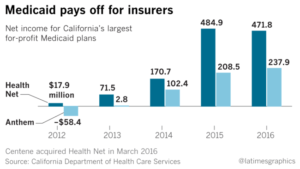

Despite health insurers’ overall low consumer satisfaction numbers compared to other industries, health insurance companies overall scores stayed the same this year after improving for two years. The fact that scores didn’t fall is probably at least partially connected to the overall stability in the health insurance marketplace. People have gotten used to coverage since the Affordable Care Act, and the ACA exchange premium increases have even leveled off. Medicaid expansion, which got a boost from voters at the ballot box last week, is also credited with providing coverage with more than 15 million Americans.

All of that makes for a stable health insurance environment, which means fewer disruptions in a person’s coverage and fewer complaints about coverage. That said, insurers have a long way to go if they are ever going to get in the same breath as more popular brands.

Questions about Medicare, private Medical Insurance and health insurance reimbursement? Physician Credentialing and Revalidation? or other changes in Medicare, Commercial Insurance, and Medicaid billing, credentialing and payments? Call the Firm Services at 512-243-6844