Plans could cover adult day care, respite care and in-home support services.

By Allison Bell | May 02, 2018 at 10:27 AM

The Centers for Medicare and Medicaid Services is getting ready to let Medicare Advantage plan issuers add major new long-term care benefits to their supplemental benefits menus.

The Better Medicare Alliance, a Washington-based coalition for companies and groups with an interest in the Medicare Advantage has posted a copy of a memo that shows CMS is reinterpreting the phrase “primarily health related” when deciding whether a Medicare Advantage plan can cover a specific benefit.

Kathryn Coleman, director of the CMS Medicare Drug & Health Plan Contract Administration Group, writes in the memo, which was sent to Medicare Advantage organizations April 27, that CMS will let a plan cover adult day care services for adults who need help with either the basic “activities of daily living,” such as walking or going to the bathroom, or with “instrumental activities of daily living,” such as the ability to cook, clean or shop.

A Medicare Advantage plan could not, apparently, cover skilled nursing home care, or assisted living facility fees. But, in addition to adult day care, a Medicare Advantage plan could pay for: In-home support services to help people with disabilities or medical conditions perform activities of daily living and instrumental activities of daily living within the home, “to compensate for physical impairments, ameliorate the functional/psychological impact of injuries or health conditions, or reduce avoidable emergency and health care utilization.”

Short-term “respite care” or other support services for family caregivers.

Making non-Medicare-covered safety changes, such as installing grab bars, that might help people stay in their homes.

Non-emergency transportation to health care services. (Plans can already pay for ambulance services for enrollees experiencing medical emergencies.)

A Medicare Advantage plan could not use the new interpretation to pay for in-home food delivery.

Coleman notes that the list of benefits a Medicare Advantage plan could cover is not exhaustive.

The Better Market Alliance says the memo is a form of subregulatory guidance. It’s possible that CMS could revise the guidance, and there’s no indication whether any Medicare Advantage issuers will be in a position to add major LTC benefits to their benefits packages for 2019.

CMS said it would be changing the 2019 Medicare Advantage program benefits uniformity requirements in the preamble to a collection of 2019 Medicare program regulations posted in April.

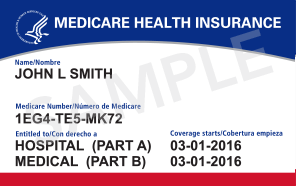

The Medicare Advantage programs lets insurers offer consumers comprehensive plans that serve as an alternative to traditonal Medicare coverage. CMS tries to control current costs, avoid any incentives for patients to get more care, and help patients shop for plans on an apples-to-apples basis by putting tight limits on the benefits the plan issuers can offer.

The Better Medicare Alliance serves many health care providers and provider groups. It also includes many insurance- and benefits-related players, including the National Association of Health Underwriters, the American Benefits Council, and Aetna Inc., Humana Inc., Scan Health Plan and UnitedHealth Group Inc.

Issuers of private long-term care insurance once treated Medicaid and Medicare benefits that “crowded out” private insurance benefits as a serious problem.

In recent years, however, as low interest rates, strict rate increase rules, and actuarial projection problems have reduced private insurers’ participation in the private LTCI market, the private issuers themselves have talked about the need for public-private partnerships.

Questions about ACA, private Medical Insurance and health insurance reimbursement? Physician Credentialing and Revalidation ? or other changes in Medicare, Commercial Insurance, and Medicaid billing, credentialing and payments? Call the Firm Services at 512-243-6844